The new world that COVID-19 has plunged us into has made it indisputably clear that our physical and financial survival will depend on how we choose to do business. Currently, part of that strategy is to minimize contact not only with others, but also with surfaces. As such, the move towards contactless interactions has skyrocketed, and businesses that have existing digital capabilities for conducting a transaction with liveness recognition have a distinct advantage over those that still require a trip into a physical space.

However, COVID-19 has also exposed the weakness of even those businesses with digital capability. Cyber-attacks that prey on the fears generated by COVID-19 have increased alongside the worldwide spread of the virus. In early April alone, Google reported a daily tally of 18 million phishing emails that led to data stealing and accounts being compromised.

As the World Economic Forum recently argued “now is the time to transition to a ‘passwordless’ future and look to biometric authentication as a solution.” In other words, the experience of the COVID-19 pandemic is expediting the need for digital onboarding of customers and clients, and there is a growing demand for digital KYC (know your customer), otherwise referred to as eKYC when the process is conducted remotely online using liveness recognition.

The current pandemic is also forcing nation states to move in the direction of allowing more flexibility in compliance and accepting more risk as identities are confirmed digitally. There is a general acknowledgement that the post COVID-19 world will more than ever include practices to conduct digital customer due diligence (CDD), and these ultimately, may actually reduce risk given that technology used to verify identities such as liveness detection for face recognition is arguably more robust than on-site identity verification.

Many businesses, particularly those in the financial sector, as well as government entities have already recognized the huge advantages of digital onboarding. Given the current reality of social distancing, eKYC has come into even sharper focus and regulators have thrown their support behind digital onboarding to ensure financial transactions are possible. In addition to the savings in the millions of dollars every year as a result of digitizing identity verification with biometrics and other advanced technologies, businesses are becoming increasingly aware of the resulting satisfaction experienced by the client when they can complete a quick and easy online onboarding. Customers today expect to be able to conduct fast and flexible interactions at any time, regardless of location or channel.

The onboarding process establishes a direct, consensual and trustworthy relationship between a business, government entity, or other organization and a client with the end result being that you Know Your Customer. Onboarding can be conducted on-site, semi-on-site, or digitally, and these are distinguished by the requirement for a client to go to a physical location to register with a business entity. As the name implies only digital onboarding is 100% remote and online.

New regulations and technological solutions have made digital onboarding more plausible and more accepted. In general, the process involves a method such as identification by streaming images, video or videoconferencing to allow a user to show and validate identity documents. The verification of documents is then followed up by the authentication of the person, most commonly through a face biometric test using liveness recognition. Identity verification is a critically important component of KYC in any onboarding process.

The move to eKYC has transformed onboarding from a tedious, costly and bureaucratic process to a streamlined, optimized, and quick process. In essence, a process that could have taken up to 3 weeks can now be conducted in minutes. The time saved for both the business and the client is significant, and most importantly translates into avoiding the loss of potential clients.

Customers today expect to be able to conduct fast and flexible interactions at any time, regardless of location or channel. However, when customers are asked for too much information, or when errors during onboarding force the customer to repeat previous steps or a process takes too long, as many as 50% of potential clients may abandon the onboarding process if they find the process too tedious or if the requirements for biometric identification are overly complex or challenging.

Digital onboarding is not just a new channel to register customers but a MISSION-CRITICAL process that will define the success of customer acquisition and, therefore, have a direct impact on the bottom line. Investing in top-rated technologies for digital onboarding, including liveness detection for face recognition, will have the same impact as IBM had in the mainframe-era: ‘Nobody was ever fired for choosing IBM’ because they represented the safe choice for best performance and reliability for a company’s mission critical data management, despite being most expensive.

Equally important to keep in mind is that the onboarding process is also a time when a business is most vulnerable to fraud. Until the eKYC process is complete, online interactions are literally conducted with “strangers”. Indisputably verifying that an individual is who they claim is therefore vital. Given that individuals involved in fraud will make every attempt to exploit any weaknesses in security measures, it is imperative to have objective proof at the time of authentication through face recognition that a person is real in real time. This objectivity is known as “liveness detection” and answers not only the question of whether the person is the right one, but if that person is alive. In other words, liveness detection distinguishes between the real person and a facsimile thereof, including photos, screen displays, video and 3D masks.

A fast, smooth and fraudulent-proof digital onboarding process is pivotal in the fight for new customers acquired online as well as customer retention.

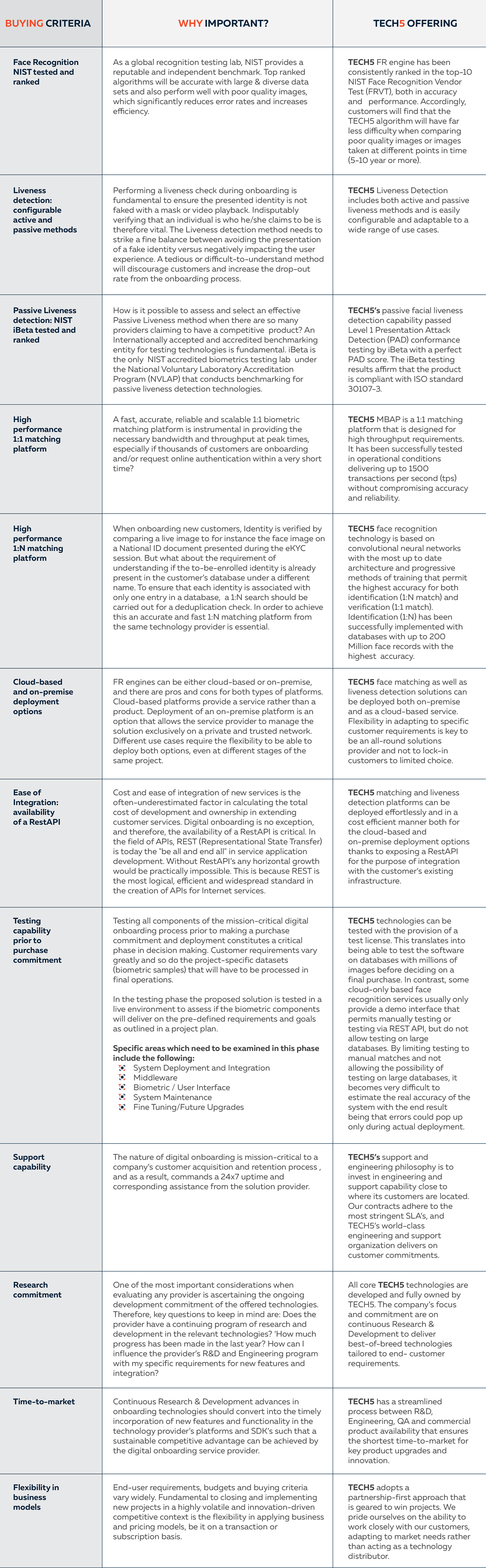

Today, customers can choose from among a wide range of eFace Recognition (FR) technologies. For example, some providers offer a cheap cloud-based 1:1 face verification service. It is also possible to acquire simple algorithms for Face Recognition 1:1 from the Internet at a very low cost or even for free. The challenges facing the customer when deciding what technology to use include understanding what sets apart a top vendor’s FR engine and related services from low cost offerings and what is most important in the context of a mission critical customer onboarding process. The following table provides some guidance for the buyer.

Regarding the choice of the FR engine, there are a few vital elements that need to be kept in mind when choosing the right product. First, the system must be accurate. Accuracy rates are often defined in terms of the True Acceptance Rate (TAR) or the percentage of times an FR system correctly verifies a true claim of identity. Rankings for the accuracy of the leading FR systems can be obtained from the National Institute of Standards and Technology (NIST) Face Recognition Vendor Tests (FRVT). As an independent standards and testing laboratory, the USA based NIST is a globally recognized centre of expertise, and its testing reports are widely used by Governments and private entities alike as a guide to vendor qualification.

The NIST contest known as FRVT 1:1 is one of the most well-known and reputable benchmarks in the biometric and face recognition world. This contest, which utilizes a diverse and closed testing database, is an ongoing competition between face recognition vendors. Because NIST databases contain many images and different datasets including Visa images, mugshots, images from border control, etc., it is possible to measure an algorithm’s true accuracy at a very high level of certainty for diverse real use cases scenarios. As a result, a top ranked NIST algorithm has a direct impact on the efficiency of face enrolment and verification against a photo on an ID document because it not only is able to handle sub-optimal and even partially occluded images with ease, but can also carry out verification using liveness recognition against a photograph that may have been taken 10 years earlier.

NIST testing results for any given FR product is one of several important aspects to consider when comparing competing products. Below we have listed other buying criteria as well as how TECH5 stands up to evaluation.

TABLE: BUYING CRITERIA FOR DIGITAL ONBOARDING SOLUTIONS

TECH5 face recognition technology is based on convolutional neural networks with the most up to date architecture and progressive methods of training that permit the highest accuracy for both identification (1:N match) and verification (1:1 match). This technology has been trained on diverse databases, and as such, the algorithm remains invariant across different nations, ages, and genders. Subjects can be recognized in any position, with any facial expression, with or without glasses, and can even be recognized after gender transformation.

The high speed and extremely accurate face recognition technology that TECH5 offers has already proven its efficiency in real world projects that work with national databases consisting of hundreds of millions of faces and is capable of processing millions of operations in real time. All data are protected as encrypted templates, which are irreversible and advanced liveness detection algorithms seamlessly prevent unauthorized access.

Given that individuals involved in fraud will make every attempt to exploit any weaknesses in security measures, it is imperative to have objective proof at the time of authentication through FR that a person is real in real time. This objectivity is known as “liveness detection” and answers not only the question of whether the person is the right one, but if that person is alive. In other words, liveness detection distinguishes between the real person and a facsimile thereof, including photos, screen displays, video and 3D masks.

There are two ways to establish liveness: active and passive. Both approaches can be gauged in terms of their compliance with principles and methods for performance on attack detection mechanisms. For active liveness the individual must respond to a challenge with a physical action/gesture such as nodding the head, following a dot etc. Passive liveness incorporates one or several of a variety of techniques ranging from analysing a selfie image to capturing a video to projecting different lights on the person. The choice between active and passive (or combination of both) will depend on the use case and the requirements of the onboarding entity like a Financial Institution or Telco Operator. In some instances, it is preferable to seek active collaboration from the individual being onboarded by informing and providing ‘knowledge’ on the process through an active liveness check. In others, a passive liveness method is chosen because this can be as simple as taking a single shot, sufficient for the technology to make a highly confident ‘liveness decision’.

Just as NIST FRVT is the authority on benchmarking FR technologies, iBeta is the only accredited biometrics testing lab by NIST under the National Voluntary Laboratory Accreditation Program (NVLAP) that conducts benchmarking for passive liveness recognition technologies. With a Quality Management System and biometrics test procedures independently audited by NVLAP in a comprehensive technical evaluation, iBeta Quality Assurance conducts independent biometric testing for wearable and mobile devices using the modalities of FR, palm recognition, voice recognition, and fingerprint recognition.

TECH5’s passive facial liveness detection capability, passed Level 1 conformance testing by iBeta with a perfect PAD score. The iBeta testing results affirm that the product is compliant with ISO standard 30107-3. TECH5 passive liveness constitutes a unique AI-based biometric solution that can distinguish between a person in front of a device and a Presentation Attack (photo, video, cut-out, mask). This solution is device agnostic and requires no specialized hardware or software on the capture side. One picture provides sufficient data to run the liveness check.

TECH5 technologies can be tested with the provision of a test license. This translates into being able to test the software on databases with millions of images before deciding on a final purchase. By providing a RestAPI customers can start testing (often within a day) and matching actual data against a large reference dataset. TECH5 engineers are available to engage with customers in the early stages of testing by providing support for systems integration, configuration and performance optimization. TECH5 Software Development Kits (SDKs) are flexible, fast, and adaptable to the needs of the client. They provide interfaces that support multiple programming languages and platforms.

In contrast, cloud-only based solutions usually only provide a demo interface that permits manually testing or testing via REST API, but do not allow testing on large databases. By limiting testing to manual matches and not allowing the possibility of testing on large databases, it becomes very difficult to estimate the real accuracy of the system with the end result being that errors could pop up only during a real use case.

TECH5 face matching as well as liveness detection solutions can be deployed both on-premise and as a cloud-based service. Flexibility in adapting to specific customer requirements is key to being an all-round solutions provider and not to lock-in customers to limited choices.

Web-based service provision (cloud-based) will have the advantage of not having to invest in systems and networking infrastructure on-site. However, customers often find that for real-time and high loaded systems an on-premise approach is more efficient and reliable because the resulting service will not be affected by internet providers and bandwidth.

With the new digital channels for client acquisition, eKYC and digital onboarding involve a significant challenge for companies for two main reasons. First, digital transformation forces companies to open digital channels for client acquisition and digital onboarding. These channels require immediacy and agility in their operations, since any time lost in the process increases the risk of losing a customer. Second, compliance with eKYC regulations demands a high level of truthfulness in data and identity assurance, which requires time and resources. The chosen technology and technology provider in supporting the digital onboarding process will have a significant impact on both.

Regarding compliance, buying decisions should take into consideration what the impact of chosen technologies will have on compliance with eKYC regulations and the importance of having implemented Internationally benchmarked technologies that adhere to standards.

In addition, digital onboarding is not just a new channel to register customers but a MISSION-CRITICAL process that will define the success of customer acquisition and, therefore, has a direct impact on the bottom line. The all-important decision for a company such as a Bank or Telco will be to determine if the chosen digital onboarding solution maximizes customer retention and reduces customer drop-out during the onboarding process.

Drop-out of potential customers during onboarding means the loss of net revenue that those customers would have brought during their relationship with a Bank or Telco had they been successfully onboarded. Such a loss can be difficult to calculate, but ultimately it will be the buyer of the ‘responsible technology’ who will be tasked with explaining to the CEO that the bitterness of poor quality and accuracy remains long after the sweetness of low price is forgotten.

The secure, yet smooth, fast and efficient digital onboarding process that T5 proposes is no longer a luxury, but a vital element for not only the growth, but retention of your customer base. This will be even truer in the post COVID-19 environment. Secure and easy onboarding has become mission critical, and cannot be left in the hands of platforms that are untested on large databases and not validated by respected standards. TECH5 offers a state of the art solution that will make real the ability to keep the identity of each client locked within their own person, thus allowing them to navigate the new reality of a predominantly digital world with complete confidence.

Read more about : AI-Based Face Capture Technology